Property Details

- Acres:279.47

- Status:Sold

- Type:Farms, Land Auctions

- Zip:60953

- Price Per Acre:n/a

- City:Milford

- State:Illinois

- County:Iroquois

Travis Selby

Illinois and Indiana Land Specialist, Broker and Auctioneer Phone:217.304.1686 Email:

travis@agexchange.com Read More

Property Description

Sold at Auction

T1 - T2 Comonation Bid: $12,500 per acre

T3: $11,100 per acre

FARMLAND AUCTION

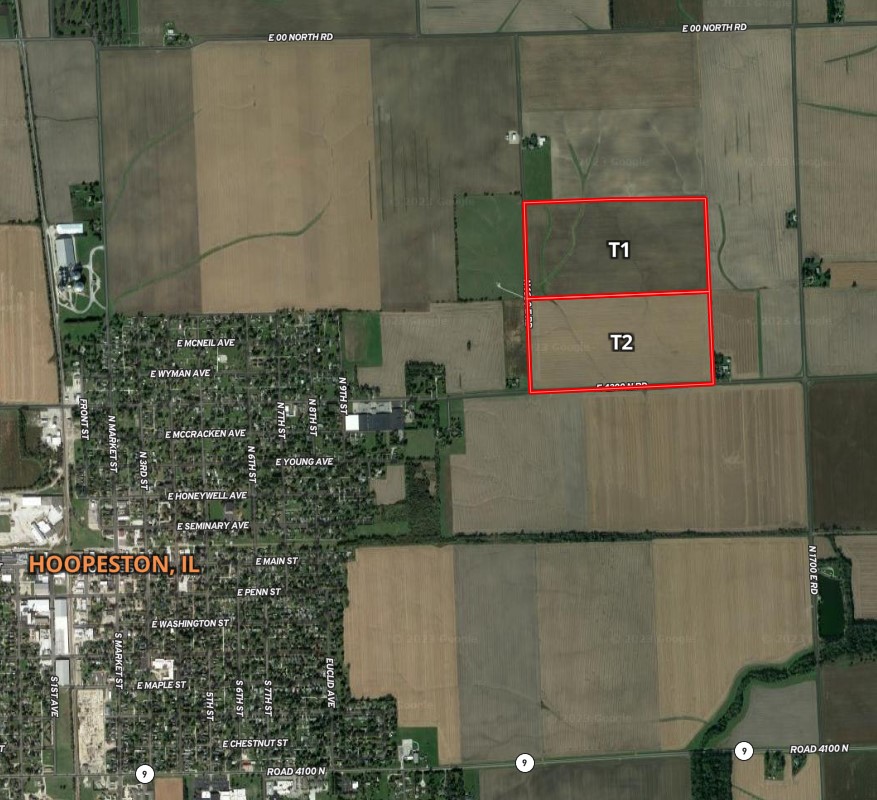

+/- 279.47 Acres offered in 3 Tracts

Grant TWP. Vermilion County, IL & Ash Grove Twp. Iroquois County, IL.

10 AM, December 7th

Auction Location:

Town and Country Event Center

35 E Jones St, Milford, IL 60953

Live, in-person auction with online bidding for pre-registered bidders.

Productive Soils

Excellent Investment Opportunity

Open Farm Tenancy for 2024 crop year

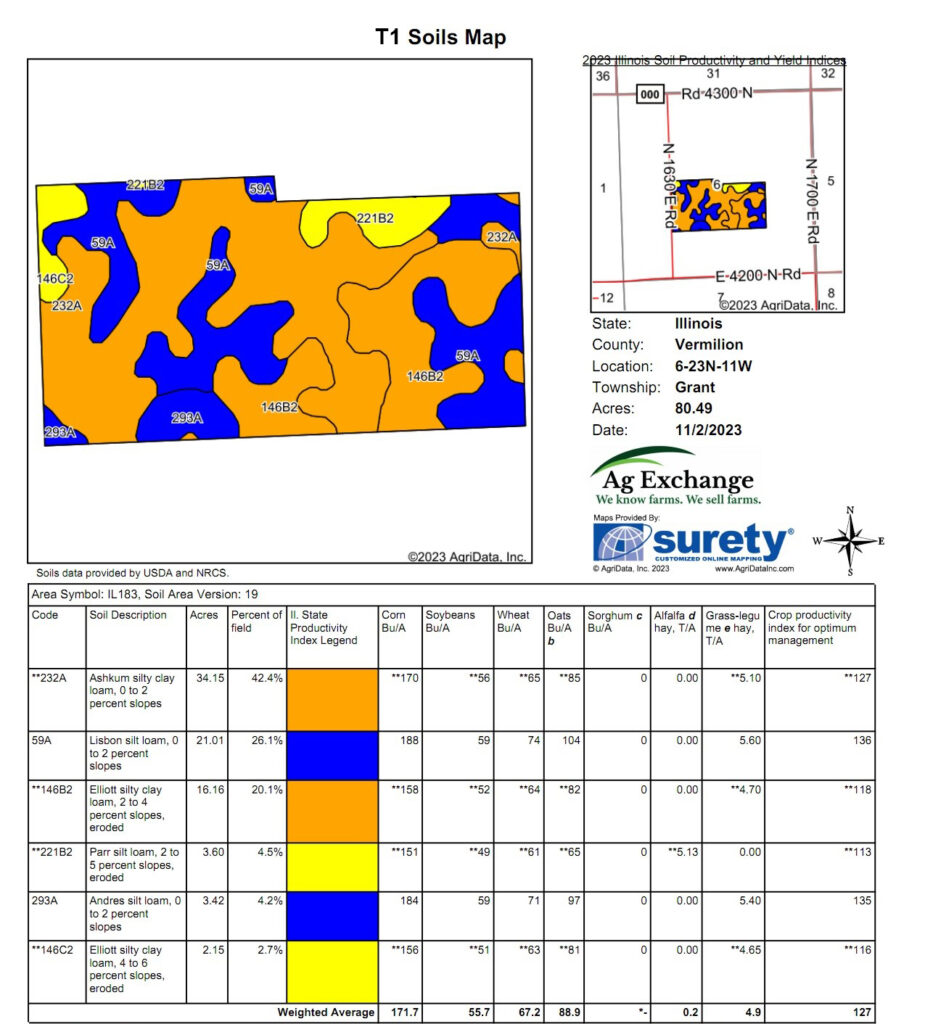

T1: +/- 81.46 Acres, +/- 76.09 Tillable Acres, 126.8 PI

Part of section 6, T23N R11W Grant TWP. Vermilion County, IL.

PIN 04-06-100-005 and the north half of PIN 04-06-300-002 and the north half of PIN 04-06-400-001.

Estimated real estate tax = $3,165.68 = $38.86 per acre.

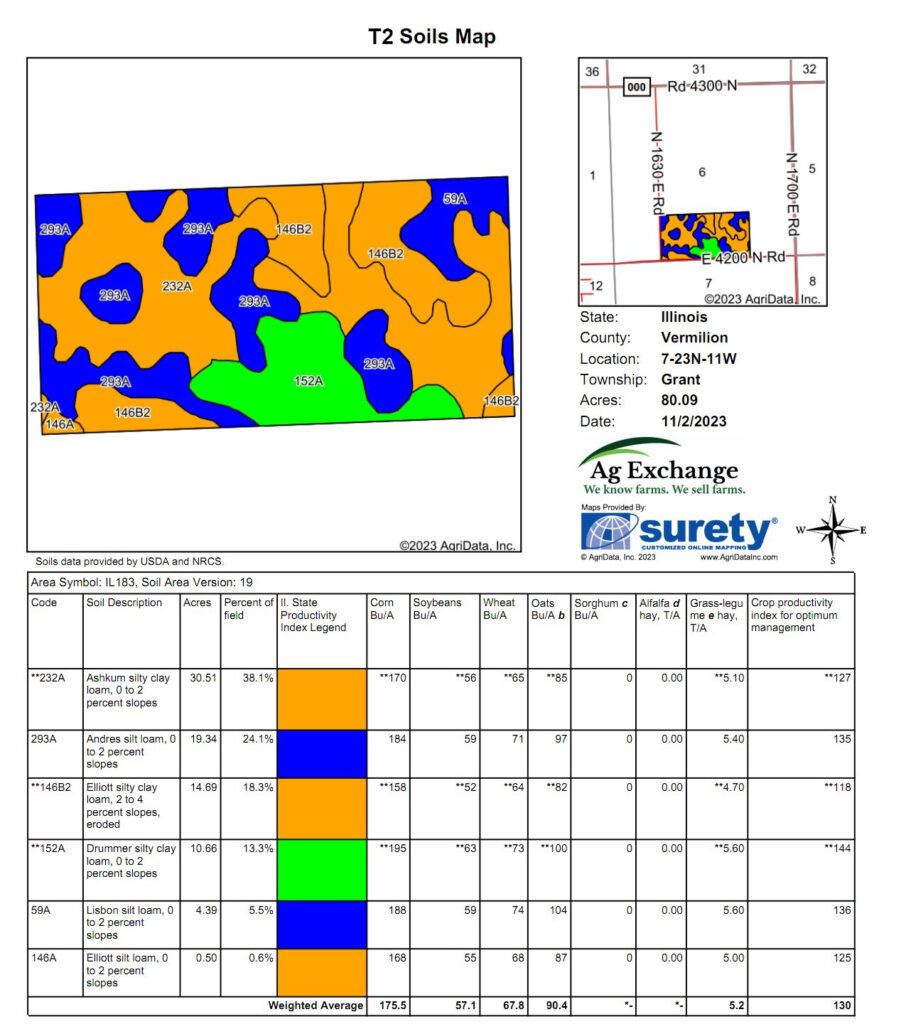

T2: +/- 80 Acres, +/- 77 Tillable Acres, 130 PI

Part of section 6, T23N R11W Grant TWP. Vermilion County, IL.

The south half of PIN 04-06-300-002 and south half of PIN 04-06-400-001.

Estimated real estate tax = $3,111.20 = $38.89 per acre.

T1 and T2, 2023 yields: 231 bushel CORN, 65 bushel soybeans.

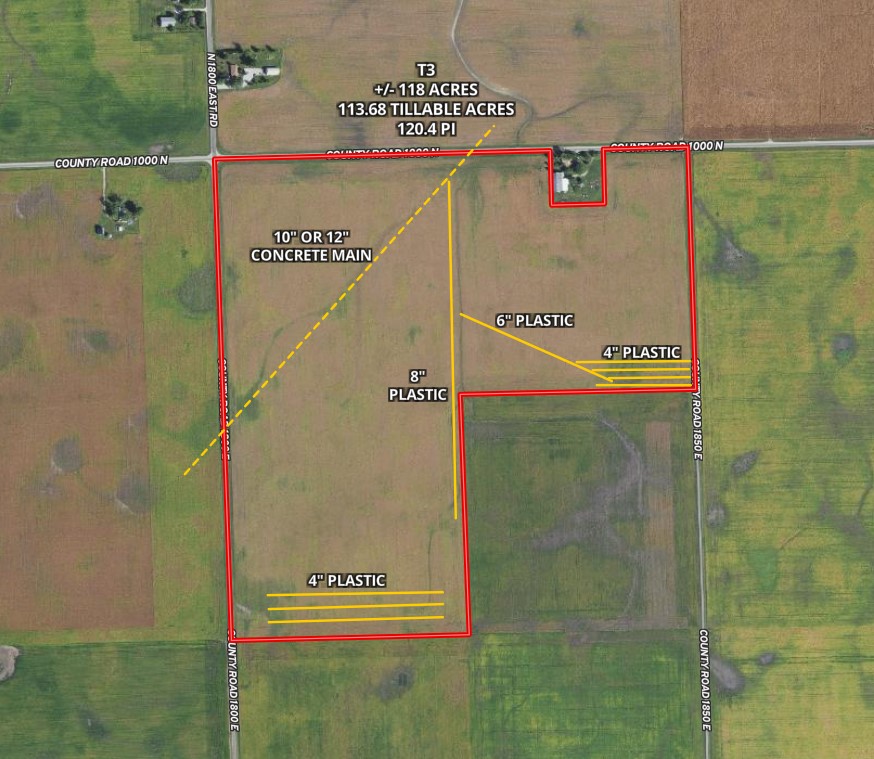

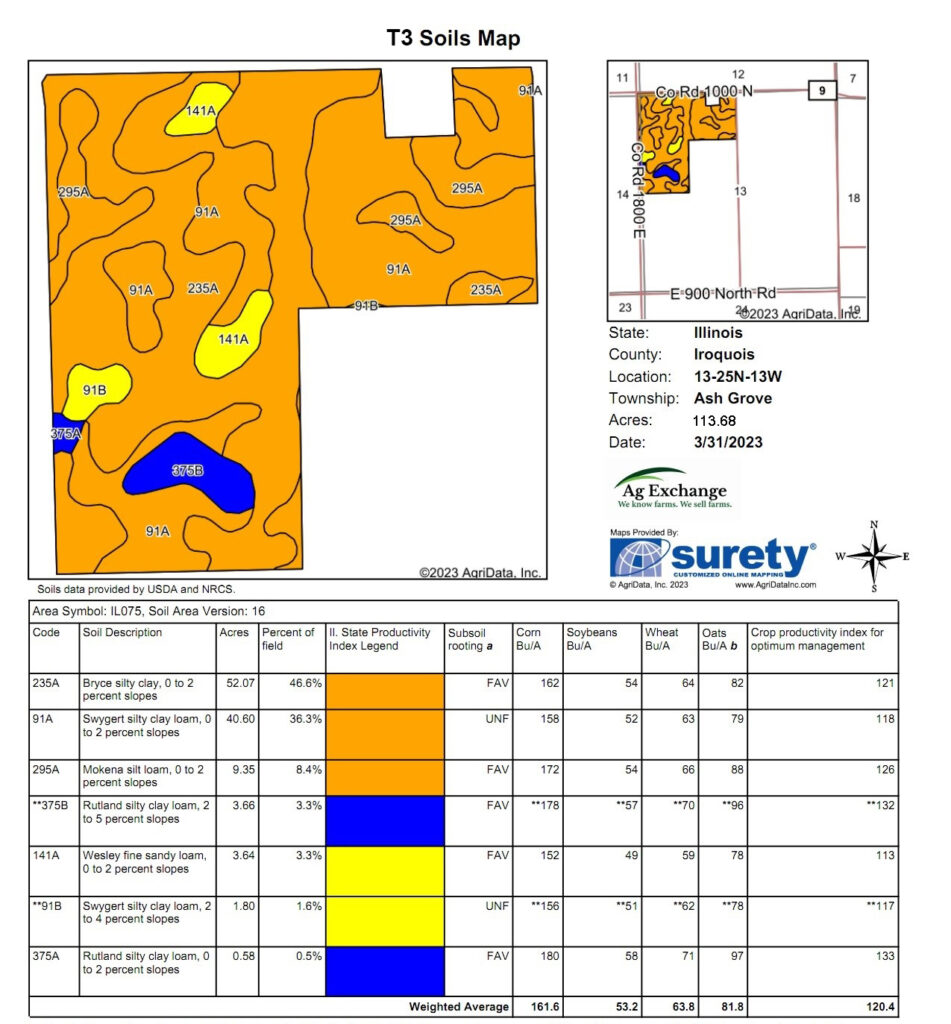

T3: +/- 118 Acres, +/- 113.68 Tillable Acres, 120.4 PI

Part of section 13, T25N R13W, Ash Grove TWP. Iroquois County, IL.

PIN 32-13-100-004. Estimated real estate tax = $3,139.04 = $26.60 per acre

T3 Yield History:

2014 222 Corn

2015 54 Soybeans

2016 197 Corn

2017 62 Soybeans

2018 218 Corn

2019 38 Soybeans

2020 202 Corn

2021 59 Soybeans

2022 207 Corn

2023 69 Soybeans

Land Broker and Auctioneer, Travis Selby

IL AUCTION Lic.# 441001485

217-304-1686

Stephanie Spiros

Owner and Managing Broker

217.304.0404

Procedure: T1 and T2 will be offered as two individual tracts, and as a combination. T3 is a stand-alone tract. T3 will not be combined in a combination bid. The auction will be conducted publicly with online bidding available for pre-registered online bidders. Bidding shall remain open until the auctioneer announces bidding closed.

BIDDING IS NOT CONDITIONAL UPON FINANCING.

SALES ARE SUBJECT TO THE OWNERS CONFIRMATION.

Acceptance of Bid Prices/Contracts: All successful bidders will sign a sale contract at the auction site immediately following the close of the bidding.

Down Payment: A 10% earnest money deposit of the total contract purchase price will be due immediately after being declared the buyer. The down payment may be paid in the form of a personal check, business check, or cashiers check. The balance of the contract purchase price is due at closing.

Closing: Closing shall take place 36 days after auction day, or as soon thereafter as applicable closing documents are completed. The anticipated closing date shall be on or before January 12th, 2024.

Possession: Possession will be given at closing.

Title: Sellers shall provide an Owners Policy of Title Insurance in the amount of the purchase price and shall execute a warranty deed conveying to the buyer(s). Sellers shall pay the premium for the Title Insurance Policy and the sellers search charges. Commitments for Title Insurance will be available for review at the office of the auctioneer and at the auction site. Bidders shall be deemed to have reviewed and approved the Title Commitments by submitting bids.

Real Estate Taxes and Assessments: Buyer shall receive a tax credit from seller at closing for the 2023 real estate tax due and payable in 2024 in the amount of: T1 = $3,165.68; T2 = $3,111.20; T3 =$3,139.04.

The buyer shall be responsible for paying 100% of the 2023 real estate tax due and payable in 2024.

Mineral Rights: the sale of the property shall include all mineral rights owned by the seller, if any.

Agency: Ag Exchange Inc. and its representatives are Exclusive Agents of the Seller.

Survey T1 and T2: A new survey shall be provided where there is no existing legal description. Any need for a new survey shall be determined solely by the seller. The cost of a new survey will be split equally between buyer and seller. The type of survey performed shall be at the sellers option and sufficient for providing title insurance. The final sale price of T1 and T2 will be the high bid amount times the final surveyed acres.

Survey T3: The sale of T3 shall not be subject to a survey.

T3 acreage is approximate and has been determined by deeds, legal description, and aerial photographs.

Disclaimer and Absence of Warranties: All information contained in this brochure and all related materials are subject to the terms and conditions outlined in the sales contract.

ANNOUNCEMENTS MADE BY THE AUCTIONEER AT THE AUCTION PODIUM DURING THE TIME OF THE SALE WILL TAKE PRECEDENCE OVER ANY PREVIOUSLY PRINTED MATERIAL OR ANY OTHER ORAL STATEMENTS MADE.

The property is being sold on an as is basis, and no warranty or representation either expressed or implied, concerning the condition of the property is made by the seller or the auction company. Each potential bidder is responsible for conducting his or her own independent inspections, investigations, inquiries, and due diligence concerning this property. The information contained in this brochure is believed to be accurate but is subject to verification by all parties relying on it. No liability for its accuracy, errors or omissions is assumed by the sellers or the auction company. All sketches and dimensions in this brochure are approximate. Photographs are used for illustrative purposes only. Conduct at the auction and increments of the bidding are at the discretion of the auctioneer. The sellers and the auction company reserve the right to preclude any person from bidding and to remove any person from the auction if there is any question as to the persons credentials, fitness, conduct, etc. All decisions of the auctioneer are final.

T1 and T2 Seller: Scott E. Stewart

T3 Seller: Clayton J. Holycross

Useful Documents

Property Map / Directions

T1 and T2: 1318 E Thompson Avenue, Hoopeston, IL Part of section 6, T23N R11W Grant TWP. Vermilion County, IL. T3: 1837 E 1000 North Rd Milford, IL. Part of section 13, T25N R13W, Ash Grove TWP. Iroquois County, IL. Live, in-person auction with online bidding for pre-registered bidders. Contact Travis Selby 217.304.1686 Stephanie Spiros 217.304.0404